“One day we will run out of oil, it is not today or tommorro, but one day we will run out of oil and we have to leave oil before oil leaves us”. This is a quote from Dr. Birol, chief economist at the International Energy Agency in a recent interview with The Independent. His statement misses a crucial point. It is not when we run out of oil that the problems begin but when we reach the peak of oil production, the moment in time after which there will always be less and less oil. Many argue that this point was passed on July 11th 2008 (peak oil day) and that we are now on the downward slope. Since energy is a pre-requisite for economic activity it is inevitable that a declining energy supply means a declining economy. No wonder the global recession.

“One day we will run out of oil, it is not today or tommorro, but one day we will run out of oil and we have to leave oil before oil leaves us”. This is a quote from Dr. Birol, chief economist at the International Energy Agency in a recent interview with The Independent. His statement misses a crucial point. It is not when we run out of oil that the problems begin but when we reach the peak of oil production, the moment in time after which there will always be less and less oil. Many argue that this point was passed on July 11th 2008 (peak oil day) and that we are now on the downward slope. Since energy is a pre-requisite for economic activity it is inevitable that a declining energy supply means a declining economy. No wonder the global recession.

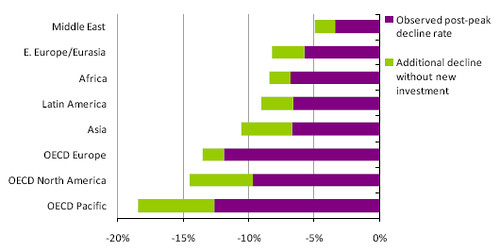

The interview is based on two reports recently published by the IEA, last November’s World Energy Outlook and this year’s “The Impact of the Financial and Economic Crisis on Global Energy Investment” written for the G8 Energy Ministers meeting in May of this year. In WEO 2008 the IEA carried out a detailed survey of over 800 oil fields (3/4 of global reserves) finding that those fields post-peak are declining at an average rate of approximately 6.7% per year.

Post peak oil decline rates by region. IEA (2008)

The report was widely seen as a watershed in the institution’s acceptance of peak oil. Since then Dr. Birol has repeatedly warned that the fall off in energy investments as a result of the recession is undermining future energy supply – “There is now a real risk of a crunch in the oil supply after next year when demand picks up because not enough is being done to build up new supplies of oil to compensate for the rapid decline in existing fields”. The May report confirms this falling investment with a ~20% drop in fossil energy investments and a 38% drop in renewables.

Global investment in new renewables-based power generation assets. IEA (May2009)

Putting this together with projected future supply the following chart was recently published on the oil drum showing a major supply crunch in 2012.

Perhaps what is most frightening about this is the IEA’s view that the world economy can get over this and continue its exponential growth rate out to the end of the century and beyond. The forecast is for world GDP to increase at 2.7% per/year from almost 100T$ today to over 1000T$ by centuries end. Don’t they see any other limits to growth like soil fertility, fish stocks, fresh water, rare earths, stable climate, species loss to name but a few?

You can read The Independent report here and the IEA May report here .