Like the proverbial fish that does’nt know what water is, we swim in an economy built on money that few of us comprehend. How money is created is not taught at school, nor at college and from an early age we accept that the creation of money is beyond our control. Although money was one of the most ingenious inventions of mankind todays system is hurting us and preventing us from creating a sustainable society. We need to rethink our relationship with money and create new ways of exchange. Money should work for us, not the other way round.

Curve A represents the growth of a healthy organism, plant or animal. After an initial rapid growth phase a maximum size or steady state is achieved. This does not mean however that growth stops altogether. In many organisms, ourselves included, there can continue to be qualitative rather than quantitative growth. Curve B represents a system in exponential growth. Growth starts off slow but then accelerates out of control getting bigger and bigger as time goes by. An example of an organism exhibiting this behaviour is usually a disease such as a bacteria, virus or cancer. These systems can be said to be in “runway” and if left unchecked continue to grow until the host is consumed. The World economy is also growing exponentially. The host in this case is our planet – the Earth.

Despite much ups and downs the world economy has grown exponentially since the industrial revolution. With each passing year our demands on energy, resources and the planet’s capacity to absorb our waste have also grown exponentially. Half of the growth of the last 2 centuries has occurred in the last 40 years. The background acceptance of every continuing growth is never questioned. Pensions, investments, savings and loans are all framed in the assumption that the future will always be bigger than the past. But consider this: It has taken 200 years for the industrial economy to reach its present size yet at just a 3% growth rate it would double again in just 2 decades. Consider twice the number of cars, televisions, houses, cities, motorways, airplanes and shipping. By 2100 the world economy would be 80 times its present size. In a finite world of declining resources is this really possible or even desirable?

It all started with dishonest goldsmiths at the time of european expansion into the new world. People kept their gold in the goldsmiths vault and traded in the receipts rather than the real gold. The goldsmiths observed that only 1 out of every 10 people ever came to redeem their receipts for real gold. They also noticed that when people borrowed gold what they really wanted was the receipts rather than gold itself. This allowed the goldsmith to lend out 10 times as much gold as was actually in his vault. Because of the need for massive expansion of credit in the new world this system was legalised and modern banking was born.

Like the goldsmiths of old who lent out many times more gold receipts than there was gold in their vaults todays banks lend out many times more electronic money than there is cash in their vaults. Today approximately 97% of the world’s money supply is electronic. Just 3% is notes and coins. In simple terms, electronic money is backed by a very small amount of notes and coins in the same way that paper money used to be backed by a very small amount of gold or silver. None of this is really surprising since we all know from films like “Its a wonderful life” that if everybody tried to take out their money as cash there would be insufficient cash to do so – i.e. a run on the bank. What is surprising and not widely known is how electronic money is created and this is the subject of the following slides.

Money is created whenever a bank makes a loan to an individual, business or government. The bank does not lend out its own money, nor does it lend out its depositors money, nor does it lend out its capital reserves. The amount borrowed is simply written into the borrowers account. We can say that when a loan is issued money is created and spent into circulation. When a loan is repaid money is extinguished and taken out of circulation. It can be said that this “credit” money is backed by whatever asset was offered for the loan. This could be a home, merchandise or simply a promise to repay. Like the goldsmiths of old who wrote gold receipts for deposited gold, todays banks create money when you “deposit” your asset. In the same way as the gold was monetised so to is your asset. The borrower then spends the money into the economy and, over time, earns it back again in order to repay the debt. The problem, however, is that the bank creates only the principal – not the interest. This means that the borrower must compete in the market place with everybody else to earn more money back than was originally spent. This requirement virtually guarantees that some borrowers will fail to repay their loans.

We can say that money and debt are two sides of the same coin. If there were no debt there would be no money. To illustrate this imagine the car salesman who has just sold a vehicle and lodges the cheque to his account. He is now in credit to the tune of say 12,000euro but only because the customer is now in debt to the same amount. In the same way Saudi Arabia has huge amounts of dollars in its accounts only because the US has borrowed those same dollars to purchase oil. Put simply, if you are lucky to have money in your account it is only because someone else has borrowed it. If all the deposits in the world were totalled they would equal the total amount of debts in the world.

It is helpful to think of the money supply as a bath of money. This bath is filled with money when banks make loans. The bath has an open drain, however, through which the loans are repaid.

Money, therefore, is constantly being created and destroyed as new loans are taken out and old loans are paid off.

A curious feature of this bath is that if no new loans were take out then the money supply would drain away. Whilst common sense would say that if everyone paid off their loans we would all be better off the truth is that we would be penniless since there would be no money. In fact there is’nt even enough money in the bath to pay off the existing debts with interest and so the banks would end up not only with all the money, but with all the assets too!

We can say that money and debt are two sides of the same coin. If there was no debt there would be no money.

Another feature of this bath is that more money must flow out than was poured in. This is because banks charge interest. The only way that this requirement can be met is if the money supply expands from year to year through the creation of every more loans. So rather than simply facilitate economic activity our money system causes a growth compulsion within society whereby each year the economy must grow in order to create the demand for new loans which in turn expands the money supply.

Foreclosures are guaranteed.

Since banks create only the principle and not the interest this means that there is never enough money in society for everybody to be able to pay of their loans. A certain amount of foreclosures are guaranteed. The rate of foreclosures increases during recessions when the money supply is shrinking.

The Lenders end up with all the money

If the overall money supply is not growing then the lenders, because they charge interest, will eventually end up with all the money. This is why in ancient times when the money supply was limited most religions banned the charging of interest. The picture shows Jesus driving the money lenders from the temple.

The Rich get Richer

Since it is mainly the rich who have money to lend in the first place charging interest represents a hidden mechanism for transferring wealth from poor to rich.

Governments can control inflation by adjusting interest rates. Deflation, however is much harder to control as it is a self-reinforcing feedback loop. In a deflation people fear for the future and reduce their spending. Businesses scale back and let go employees. Unemployment rises. People and businesses reduce borrowing and try to pay off any outstanding debts. The result of this is a shrinking supply of money. As everybody competes in this shrinking pool companies go out of business and others reduce their prices. The cycle then repeats itself.

The standard response to a deflation and the one being adopted by governments worldwide is to inject money into the economy through further borrowing. This, however, piles up more debt for the future on the assumption that there will be more growth in the future. Almost every recession in history has been solved in this way. The difference now is that the current recession is happening in the context of declining resources – especially energy resources which are a pre-requisite for economic activity.

We can visualise our economy as two amounts of money. The amount on the lefthand side represents all the borrowed money. Since almost all money in society is borrowed (except for the 3% of cash) this also represents the money in society. The amount on the right hand side represents the money owed which is greater than the amount borrowed since banks create only the principal and not the interest.

What this means is that at any one time the amount of debt in society is much greater than the actual amount of money in society. The only thing that stops the system from failing is the time delay between when the money is borrowed and when it is paid back and the pre-requisite that in between those times there is growth in the money supply.

But since the money supply can only increase through further bank loans this means that each year more and more money must be borrowed in order to create the new money to pay off the old debts and prevent the money supply from shrinking. We are in effect, caught in a trap of perpetual debt. As more money is borrowed more money is owed – year after year after year.

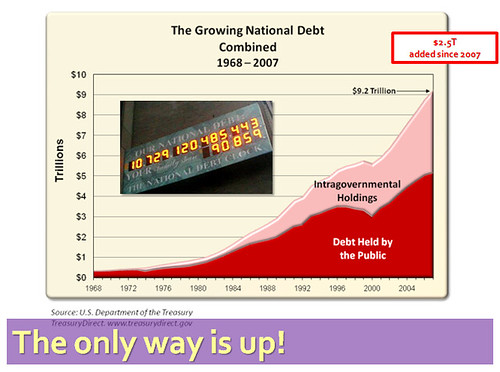

Here is another exponential curve like the ones shown earlier, the debt of the US government. The photo is of the US Debt clock in New York which conveniently shows how much this amounts to per family.

From 1968 it took over 20 years to add $2Trillion to the debt. But from 2007 it took only 2 years to add the same amount. What will it be added next year? Another $2Trillion? This is the true nature of exponential growth, a curve that begins to grow very slowly but then finally grows in an almost vertical fashion.

The ability to pay of this debt is based on the assumption that there will be more economic growth in the future. Our monetary system is designed to go in one direction only – up! The money system, therefore, is incompatible with the achievement of a sustainable society since this necessarily requires a steady state economy – i.e. a no-growth economy and a fixed amount of non-debt based money.

In summary, if there is no growth in the economy our money supply will shrink in a deflationary spiral. In order to create a sustainable society we need a new form of money, one that is not based on debt or the payment of interest. The best we could hope for is that new money systems could be introduced as the old debt based system “unwinds”. Given that governments are committing to massive new borrowings, this is unlikely. More likely is a series of mini-collapses or worse a complete freeze of the banking system. Local currencies, Mutual Credit associations, LETs systems are important because they sow the seeds of this new money system. They also tell a new story about money, one in which people themselves create the means to exchange rather than borrowing it from banks at interest.

What is money anyway? Consider finding a foreign coin in your pocket. You spend the coin because it looks like an ordinary coin. The shopkeeper finds the coin in the till, but gives it out as change, since s/he does’nt want to be stuck with it either. The coin continues to be passed on in this way until finally it gets stuck in a car park machine or put in a jar. We all know that the coin is worthless but nonetheless it was passed around the economy from buyer to seller enabling economic transactions to occur. The lesson is that the real wealth is not the coin but the goods and services we exchange with each other.

The truth is that money is simply a means to to exchange real wealth. The real wealth in a society is the goods and services that we trade with one another.

We can therefore say that we, the citizens, create the real wealth in our society. If we create the real wealth in our society then why do we not create the means to exchange that wealth as well?

Why is it that we must borrow the means to exchange from private banks, who never had it in the first place and then pay it back to them with interest?

Put another way, why are the people who create the real wealth in society indebted to bankers who simply created the means to exchange the wealth?

Like the proverbial fish in the pond who has no concept of water it is time for us to understand the true nature of money and take back control.