What is money anyway?

Everybody has had the experience of finding a foreign coin in their pocket that they are able to spend because it looks identical to an ordinary coin. The foreign coin is worthless and yet it passes from hand to hand enabling a whole sequence of small economic transactions to occur until finally it gets stuck in a cash machine or put in a jar. The point here is that this worthless piece of metal enabled real worth to change hands. It is the goods and services that we trade with each other that have real value, money is simply the means of exchange.

Throughout the world as national money supplies shrink and credit dries up local communities are finding new ways to keep economic activity alive. This primer is intended as an introduction to the concept of local community currencies. It has been prepared by Future Proof Kilkenny for the Kilkenny Chamber of Commerce, Kilkenny Enterprise Board, Kilkenny Local Authority, Kilkenny Tourism, High Street Traders, Mayor Malcolm Noonan and any other parties interested in local economics.

What is a local currency?

”Traders and suppliers have truly embraced the Lewes Pound and are using it to good effect. By paying their own suppliers in Lewes Pounds, they in turn spend them with other Lewes businesses, thus creating a virtuous circle that benefits the town.“

A local currency is a means of exchanging goods and services within a community with something other than the national currency. It is usually confined to a specific geographical region like a town or county. A local currency does not intend to replace the national currency but to complement it. By providing an alternative means of exchange local economies can become resilient to the boom/bust cycles of the global economy.

There are many successful local currencies in operation throughout the world today. From the Toronto Dollar to the Japanese Fureai Kippu to the Lewes Pound. As the global credit crunch continues communities are developing alternative means of exchanging wealth and in the process meeting local needs with local resources – a key step on the path to a sustainable society and the rebirth of local economies.

Local Economies

Money enters a local economy in 3 ways:

1. Trading with the outside world

2. Borrowing from National Banks

3. Government spending

Today these money flows are shrinking and paralyzing local economies. This is despite the fact that local businesses are still producing goods that local people need – there just isn’t the money there for trade to continue. To put it another way it is not local trade that is shrinking but the means of exchange.

The issue is not necessarily that too little money flows into a neighbourhood. Rather, it is what consumers, public services and businesses do with that money. Too often it is spent on services with no local presence, and so immediately leaves the area.

Leaky Buckets!

As well as having to contend with the shrinking amount of money entering the local economy we are also facing the ‘leaky bucket’ syndrome. This is where any money that is spent locally leaks out again through purchases of goods and energy, payments on taxes and loan repayments. When some of the local money pool is in the form of a local currency or when some of the incoming money is converted into local currency we are plugging some of the leaks by confining the money within a defined geographical region.

In addition local currency provides a way for wealth that is produced locally to benefit local people rather than being siphoned off to distant companies or investors.

Valuing the local economy

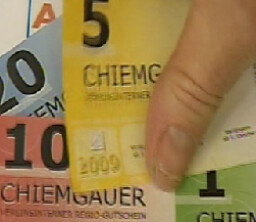

Local currencies tend to be used more as a means of exchange than a store of value. In other words people don’t save them they spend them! This is especially true when the currency has a discount built-in, an expiry date or looses its value with time (Demurrage). The result of this is a faster rate of use of the local currency – what economists call ‘velocity’. It gets spent, reissued as change, spent again much faster than conventional currency. A study of the Chiemgauer local currency in Germany showed that the local currency was spent on average 3 times more than the euro. A local currency can be thought of as a way for citizens to continually re-invest in their local economy. On a social level it reconnects consumers with producers and re-instates the value of local shops, crafts people, restaurants and businesses.

Local currencies lead to economic opportunities

3 million Chiemgauer notes are in circulation, over 600 businesses in the Lake Chiemsee region of Bavaria accept them and 100K euros has been raised for charities and schools.

An interesting benefit of a local currency is that it can highlight niches in the economy where there is no local supplier. If, for example, a shop finds itself unable to spend the local currency on supplies this represents an opportunity for a local producer to fill that niche. For example a toystore that hitherto imported all its stock might seek out a local craftsperson to dispose of its excess local currency rather than trying to continually re-issue it as change or redeem it with the issuers. Another example might be a restaurant who might seek out local food producers with whom to spend the currency in preference to importing supplies from abroad.

Different types of local currency Local currencies exist on many levels and for many purposes. They can have both social and commercial objectives and generally fall into 3 broad categories:

1. Business to Business

2. Consumer to Consumer

3. Business to Consumer

Business to Business (B2B)

B2B currencies have a commercial purpose designed to keep credit flowing between businesses. Some businesses already practice a type of local currency by issuing credit notes to one another or by making contra payments within their accounts thereby reducing the amount of ‘real’ money that needs to change hands. B2B local currencies formalise this arrangement through a 3rd party that is sometimes cooperatively owned.

The best example of a B2B currency is the WIR system in Austria. Although consumers may join it is primarily a system whereby businesses can trade and extend credit to one another in something other than the national currency. Feasta’s liquidity network currently under discussion with local authorities is another example of a system designed to deal with tight cash flows.

Consumer to Consumer (C2C)

C2C currencies have primarily a social purpose and the best example of this is the Japanese Fureai Kippu or ‘Caring Relationship Tickets’ – sometimes called ‘Care Miles’. This is a computerised system whose unit of account is one hour of service whereby those in need of care, say help in shopping or food preparation, pay in Fureai Kippu. These tickets can be saved by the carer for their own use in the future or transferred to those of a family member or other person in need of care who may live in a different part of the country.

The Japanese system is a specialised local currency designed to satisfy the need of an aging population requiring care. A more familiar example of a C2C currency is the LETs (local employment trading system) which first originated in Canada in 1992. LETs systems normally use time as the unit of account and examples inlude TimeBanks and Ithaca Hours. The beauty of the system is that the means of exhange is created whenever two people wish to trade. No money is required beforehand. The buyer goes into debt for the number of hours worked whilst the seller goes into credit for the same amount. The seller can ‘spend’ his/her accumulated hours with another party and likewise the buyer can get out of debt by offering his/her services to another party also. LETs groups are based on trust and build social capital literally 1 hour at a time.

After joining a LETs group members may begin trading immediately regardless of whether they have credit or not. An individuals account starts at zero and if s/he decided to leave the system the only requirement is to bring their account back to zero. Some systems have limits on how far into debt or credit a member can go. The weakness in the system is that it is confined to members only, is not highly visible and often fails to engage the wider community. LETs groups tend to stall when the members who have highly desirable skills accumulate a lot of credits but find themselves unable to spend them.

Business to Consumer (B2C)

The Kilkenny Chamber Shopping Voucher Scheme launched during Christmas 2008 was a form of local currency.

This is the most common form of local currency and is designed specifically to encourage citizens to support their local businesses. In fact many businesses already practice a form of local currency by issuing discount vouchers, Think of airline companies awarding frequent flyer miles or supermarkets issuing clubcards or bookstores selling book tokens. These examples are all a form of currency, i.e. a medium of exchange, designed to increase trade for the business. In fact it is useful to think of a local currency as a book token, but rather than a once-off transaction in one particular store, it can be used in any store for any purpose. Furthermore it can be issued as change to another customer, thereby continuing to circulate and facilitate trade within the local economy.

The most successful B2C currencies use paper as the media rather than electronic accounting or a physical commodity. They are normally denominated in units equal to the national currency thus making them easy for businesses and customers to use. In times of economic crisis, however, local currencies have been denominated in something tangible like a weight of coal or grain.

BerkShares – An example

The most common method, but by no means only method, of issuing a local currency is by citizens purchasing them using national currency at some central point like a credit union, post office or tourist office. The money used to purchase the currency is held in a safety deposit box or bank account. When local currency is sold a discount is normally offered to encourage its use. For example the BerkShares in Massachusetts can be purchased for 95 cents but can be spent in local participating stores and restaurants as if they were 1 dollar. The businesses are in effect offering a 5% discount in return for increased patronage and advertising. In a recession when most businesses are discounting anyway it can be advantageous to discount via the local currency because, for reasons outlined previously, the money remains within the community and is spent more frequently.

Berkshares are accepted at more than 400 businesses in the Berkshire region of Western Massachusetts with more than $2.5million in circulation.

When a business accepts the local currency they can either give it back out to the public as change (preferable but customers are not oblidged to accept them) or redeem then for national currency with the issuing office. In the case of the BerkShares when 1 BerkShare is redeemed the business only recieves 95 cents – the same 95 cents in fact that was used to purchase it. By giving out the local currency as change however, the business is actually getting the full value because the customer is accepting them instead of 1 dollar. This is the motor behind the reason why local currencies are spent more often than national currencies. Put simply consumers cant wait to spend them and businesses cant wait to get rid of them!

Most local currencies start off as a pilot project for a fixed period of time. At the end of the project the currency can be turned back into national currency with the issuing office. It is advantageous to restrict redemption to businesses only thereby forcing citizens to ‘spend’ the last of their notes before they become void. This has the effect of a final boost in sales before the end-date. This is actually a crude form of the ‘Demurrage’ principal mentioned earlier whereby money decays in value over time. Sometimes described as a ‘parking fee’ Demurrage discourages people from hoarding the local currency and encourages them to spend it.

A variation on the discounting method described above is to issue the currency at parity and encourage businesses to offer discounts at the till. This is the method being employed by the Kenmare ‘Youro’. Whilst this makes the currency harder to get into circulation in the first place it is easier for people to accept them as change since they will get a discount the next time they use them.

The Toronto dollars raise money for children in need. www.torontodollar.ne

Local currencies and fund raising

At the end of a pilot project there is normally some monies left over. Many people, especially tourists, hold onto some currency for sentinmental reasons. A fixed period local currency can therefore be used to raise money for a local charity and this can be explained in the promotional literature.

In an established local currency where there is no end date a percentage of the purchase price can be given to a charity that the buyer chooses from a list. In this case the currency is slightly more expensive to buy or the discount at the shops is less.

Design of local currency notes

Burlington currency notes designed by local school children.

There are many exciting ways in which communities have designed their local currency highlighting the cultural diversity of their locality. The work of local artists, heroes and sporting champions, arts fixtures and festivals, regional produce as well as famous landmarks and historical buildings can all feature on the notes. In this way a local currency has a sense of place and gives people ownership of ‘their’ money.

Local currencies and tourism in Kilkenny

Given the strength Kilkenny has as a destination tourism is one obvious vechicle to introducing a local currency is tourism. When a tourist converts their money into a local currency, rather than leaking back out of the economy that money has been ‘captured’ within the local economy and becomes a freely circulating medium of exchange enabling economic activity to continue long after the tourist has returned home.

Summary

Kenmare ‘Youro’ sample notes and signage. The project was launched on 15th May of this year and will run till the Autumn.

Local currencies are a novel way of supporting local business and keeping a small amount of wealth circulating within a local economy. They encourage citizens to value local producers and play an important role in building community and a sense of place. By having an alternative currency, however small, a community can become more resilient to the boom/bust cycles of the global economy. A local currency can raise funds for charity, promote tourism and culture, identify unmet business opportunities and match local needs with local resources.

Perhaps the most important aspect of a local currency, however, is that it tells a new story about money – that the real wealth in a community is the goods and services that the citizens exchange with one another. Money is simply the means of exchange. This understanding empowers us to realise that we are not married to the money system. As we enter a new era of peak oil and global economic uncertainty local communities need new ways and new thinking to offer people employment, pay for goods and services and create economic support networks.

Although small in scale at present it is vital that such mechanisms of trade are piloted. In these difficult economic times we may come to rely on them to a much greater extent in the future. Local currencies are one part of the jigsaw puzzle in our combined efforts to create a sustainable society.